What's the skinny on FSA/HSA accounts? Let's break it down!

By Ceres Chill

Photo from forumdaily.com

Having an HSA or FSA might be extremely beneficial to you, even if you don't have medical costs like prescriptions and/or appointment copays. The list of eligible products is twice as long as it used to be, so the chances that you would use those funds on products that you would end up buying anyway (like bandages, sunscreen, first aid kits...or the coolest breastmilk storage products around) are pretty high!

According to fsastore.com, an estimated $1,600 is spent by households each year on health care products that could otherwise be purchased using FSA or HSA dollars. That is a huge chunk of money.

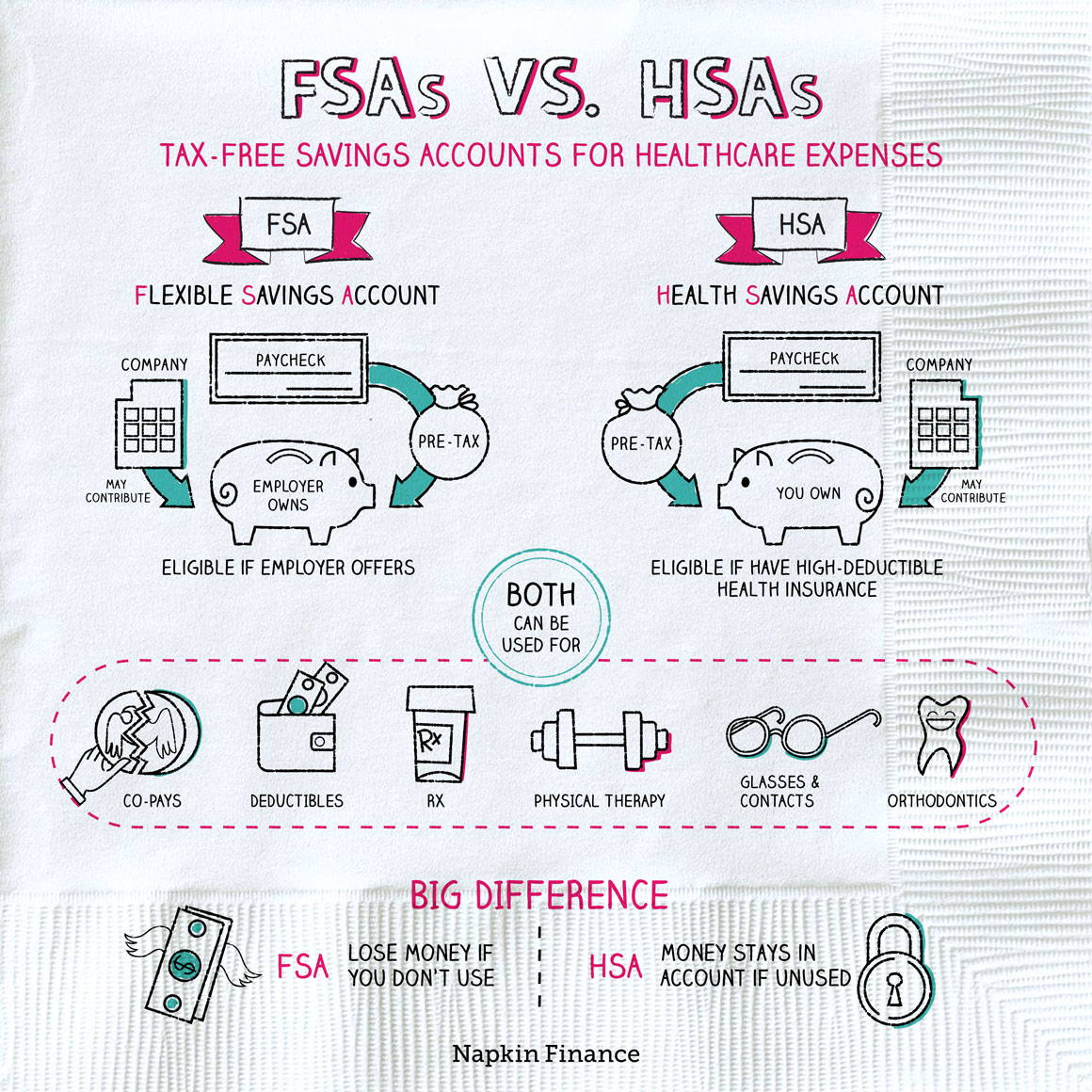

Here's all you need to know about these pre-tax accounts.

What is an FSA?

FSA (short for flexible spending account) is a special account opened by your employer that you put pre-tax money into to pay for out-of-pocket healthcare costs. It is often part of a benefits package offered by your job, and you can request that a portion of your paycheck go to the account.

You have to use your FSA money before the end of the calendar year as there is usually no option to carry it over to the next year. If your employer does allow you to carry the funds over, you are only allowed to do so with up to $610.00. Still, more often than not, if you don’t use your FSA dollars in full by the end of the year, you lose them. Pretty frustrating, right?!

In 2019 and 2020, FSA account holders forfeited over 7 billion dollars that wasn’t used before the December 31st deadline. More than 40% of workers forfeited at least a portion of their funds according to the Employee Benefit Research Institute, so it is incredibly important to use those FSA dollars before the year ends!

P.S. - some FSA providers allow you to submit claims up until March for expenses you incurred in the previous plan year, so make sure that you request a reimbursement for eligible products before then!

What is an HSA?

HSA (health savings account) is a special pre-tax account that allows you to pay for out-of-pocket healthcare costs and take tax-free withdrawals to pay for covered care. It’s created for or by individuals covered under high-deductible health plans, and contributions are made by the individual or their employer. The money in an HSA can be invested and grow over time and can also be withdrawn after 65 and will be taxed at your ordinary tax rate with no penalties.

What's the difference between the two?

While both FSA and HSA accounts allow you to pay for eligible expenses with pre-tax dollars, there are some key differences:

Photo from financialstaples.com

What is eligible?

A lot more than you’d think! Aside from obvious eligible expenses (medical, dental, vision, etc), things like childbirth expenses/classes, infertility treatment, feminine hygiene products, breast pump and nursing accessories can be reimbursed by your provider. Some surprisingly eligible products include DNA tests, deep muscle massagers, pimple patches and more!

Check out this long list of FSA/HSA eligible expenses, and visit Amazon’s FSA/HSA store to see how you can use your funds!

Why is Ceres Chill eligible?

Ceres Chill is FSA and HSA approved reimbursable because we fall under the breast pump and lactation supplies category as a medically necessary product! The Chiller, Milkstache and Shield Maidens are all eligible expenses for use of these special medical funds.

Check out the eligible products here!

Products that are for pumping and milk storage are considered medically necessary because they assist us in accomplishing something that is often critical to our health and the health of our children. It’s nice to see the healthcare industry, our federal government and our elected officials finally recognizing the importance of products like Ceres Chill that support families in their breastfeeding journeys!

We can now accept FSA/HSA cards directly through our website, so you can use your cards or get reimbursed! Please know that while we are authorized to accept these cards, the decision to approve or deny a transaction is up to your provider. If your card gets declined, please reach out to us at info@cereschill.com. We may not be able to push that payment method through, but we can provide you with an itemized receipt that you can use to request a reimbursement.

Further reading